amazon flex tax forms uk

We know how valuable your time is. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906.

Delivering For Amazon Flex Requirements Driver Pay Work Overview 2022 Review Ridesharing Driver

Tap Forgot password and follow the instructions to receive assistance.

. Payee and earn income reportable on Form 1099-MISC eg. Keep track of what you spend on Amazon Flex. You can ask Amazon for your 1099.

Our dedicated driver Support is available to answer your questions 247. Royalty or rent income by participating in one or more Amazon programs you may be eligible to receive a. Its a legal requirement that you have delivery driver insurance for this type of job.

Hey fellow British Flex drivers. 600 is the IRS minimum and it costs Amazon money to send tax forms. Lets take a closer look at what this.

Amazon Flex Business Phone. Keep your app updated to the latest version. Gig Economy Masters Course.

Ive been doing Flex in Glasgow Motherwell and Glasgow depots for about a month now to compliment my full time 9-5 job. Turn to podcasts for company. If you are a US.

Increase Your Earnings. UK drivers and doing your taxes. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or.

1099 NEC Tax Forms 2021and 25 Self-Seal Envelopes 25 4 Part Laser Tax Forms Kit Pack of FederalState Copys 1096s Great for QuickBooks and Accounting Software 2021 1099-NEC. Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least 600 working for the service within the tax year. 1099 Misc Tax Forms for 2021 with Envelopes 4 Part Laser Tax Forms Kit for 25 Individuals Income and 25 Self-Seal Envelopes - Designed for QuickBooks and Accounting Software Made.

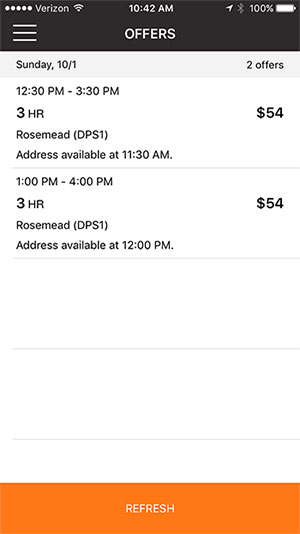

Adjust your work not your life. Stack Amazon Flex with other delivery apps. For general questions andor programme feedback visit the Help tab in the apps main menu to contact our.

A few basic hints and tips for registering as self employed sole trader and information on when and how to file your tax returnThis is rather a broad topi. Select Sign in with Amazon. With Amazon Flex you work only when you want to.

If you made less than 600 you usually wont get a 1099 for Amazon Flex income. Amazon Flex drivers receive 1099-NEC forms from the company. If you participate in Amazon Flex or have participated in a similar program you can request a copy of your 1099 from Amazon.

Whatever drives you get closer to your goals with Amazon Flex.

How To Do Taxes For Amazon Flex Youtube

How To File Amazon Flex 1099 Taxes The Easy Way

Amazon Flex Delivery Driver Uk Hi Why Is My Standing Going Down Lately As I M Doing Everything That I Need To Going On Tine Finishing On Time Not Cancelling

Frequently Asked Questions Us Amazon Flex

Amazon Flex Background Check What You Must Know Ridester Com

![]()

Amazon Flex Deliveries Mileage Claim Moneysavingexpert Forum

How To File Amazon Flex 1099 Taxes The Easy Way

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

Amazon Flex Beginner S Guide To Amazon Delivery Driver Jobs Uk Ni

![]()

How To Fix Amazon Flex App Issues Money Pixels

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

The Best Tips For Amazon Flex Fba Drivers Everlance

Amazon Flex Drivers Uk Facebook

Amazon Flex Uk Self Employed Self Assessment Tax Basics Registering Basic Tax Advice Easy Youtube

Amazon Flex Delivery Driver Uk Facebook

Delivering For Amazon Flex Requirements Driver Pay Work Overview 2022 Review Ridesharing Driver